PLGA Market by Composition, Application (Medical, Non-Medical Applications), Processibility (Extrusion, Injection Molding), End-Use Industry (Healthcare, Biotech Firms, Medical Institutions, Packaging, Textile, Agriculture) - Global Forecast to 2030

Updated on : April 15, 2024

PLGA Market

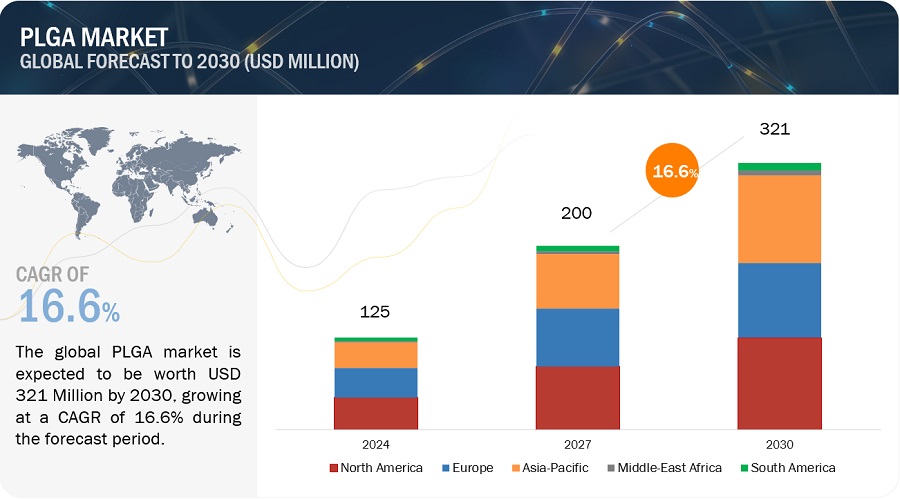

PLGA Market was valued at USD 121 million in 2023 and is projected to grow from USD 200 million in 2027 to USD 321 million by 2030, growing at 16.6% cagr during the forecast period. As a biodegradable and biocompatible polymer, PLGA has garnered significant attention across various sectors, particularly in pharmaceuticals, healthcare, and beyond. Its versatility and tunable properties make it an ideal candidate for drug delivery systems, implants, tissue engineering, and a host of other applications. With the global healthcare sector witnessing a paradigm shift towards personalized medicine and advanced therapies, the demand for PLGA-based products continues to soar, driven by the need for targeted drug delivery, improved patient outcomes, and reduced side effects. Moreover, the growing emphasis on sustainability and environmental stewardship further bolsters the market for PLGA, as businesses seek eco-friendly alternatives to traditional plastics in packaging, agriculture, and other industries. Companies operating in the PLGA market are investing in research and development to enhance product performance, expand application areas, and capitalize on emerging market trends.

Attractive Opportunities in the PLGA Market

To know about the assumptions considered for the study, Request for Free Sample Report

PLGA Market Dynamics

Driver: Government initiatives and regulations

Government initiatives and regulations wield substantial influence over the trajectory of the PLGA market. Regulatory support for biodegradable polymers, notably PLGA, varies globally, impacting market dynamics in significant ways. For instance, countries like Germany and France have implemented stringent regulations favoring eco-friendly materials in packaging. This has propelled the adoption of PLGA in the packaging industry, aligning with environmental directives and creating a demand for sustainable alternatives. In the healthcare sector, the US Food and Drug Administration (FDA) emphasizes the importance of biocompatibility and biodegradability in medical devices. This aligns with the qualities inherent in PLGA, positioning it favorably for use in medical implants and drug delivery systems. The European Medicines Agency (EMA) also follows a similar path, promoting the use of biodegradable materials in pharmaceutical applications, bolstering the market for PLGA-based drug delivery solutions. Furthermore, countries like Japan, with a strong focus on technological innovation, have implemented supportive policies for research and development in biodegradable polymers. Such initiatives encourage companies to invest in advancing technologies related to PLGA, fostering innovation and market growth.

Restraint: Complex manufacturing process

The complexity of manufacturing processes stands as a significant restraining factor for the PLGA market. PLGA is derived from the condensation polymerization of lactic acid and glycolic acid, requiring precise control over reaction conditions, temperatures, and catalysts to achieve the desired molecular weight and composition. This step alone demands a high degree of precision to ensure the quality and characteristics of the final PLGA product. Subsequent to the polymerization, the purification process involves multiple stages to eliminate impurities and unreacted monomers. Achieving the required level of purity is critical for the biocompatibility and performance of PLGA in various applications. The purification process adds an additional layer of complexity to the manufacturing sequence. Furthermore, the formulation of PLGA-based products often involves incorporating therapeutic agents or tailoring the polymer for specific applications. Achieving uniform dispersion of drugs or additives within the PLGA matrix requires meticulous attention to formulation parameters and the use of specialized equipment. This step contributes to the overall complexity, especially in the context of developing controlled drug delivery systems with precise release profiles. The intricate nature of PLGA manufacturing is also evident in the processing steps, where the polymer is shaped into various forms such as microspheres, nanoparticles, or implantable devices. These shaping processes require advanced technologies and a deep understanding of the material's behavior under different conditions.

Opportunity: Global expansion in healthcare industry

The global expansion of healthcare infrastructure presents a strategic opportunity for PLGA-based products. In response to evolving healthcare systems worldwide that prioritize advanced therapeutic solutions, PLGA emerges as a pivotal player to meet the escalating demand for efficient and patient-friendly medical interventions. In the US, PLGA-based drug delivery systems are gaining prominence, aligning with the country's focus on personalized medicine. China's robust healthcare growth, fueled by government initiatives, positions PLGA favorably in drug delivery and regenerative medicine applications. In India, PLGA's role in controlled drug delivery resonates with the nation's emphasis on affordable and accessible healthcare solutions. The European Union's commitment to sustainable healthcare practices opens avenues for PLGA's biodegradable properties in medical products. Brazil's expanding healthcare market offers opportunities for PLGA in medical implants and drug delivery systems. Across the Middle East and North Africa, investments in healthcare infrastructure create opportunities for PLGA applications in emerging markets. In Japan, PLGA finds a niche in regenerative medicine and medical devices amid an aging population and a conducive regulatory environment. This global panorama underscores PLGA's versatile applications and positions it strategically in the dynamic landscape of evolving healthcare needs.

Challenge: Cost intensive process and scalability problem.

Cost factors pose a substantial challenge in the PLGA market, particularly during the production phase, where the synthesis of high-quality PLGA relies on raw materials such as lactic acid and glycolic acid. The cost-intensive nature of procuring these raw materials, coupled with their potential price fluctuations, introduces intricacies into the overall cost structure of PLGA production. Manufacturers are confronted with the dual challenge of ensuring affordability for PLGA-based products and navigating the susceptibility to raw material cost fluctuations, which can directly impact profit margins.

Furthermore, the scalability of PLGA production compounds the challenges facing manufacturers. With an escalating demand for PLGA-based products, companies are tasked with the intricate process of scaling up production while upholding consistent quality standards. This undertaking requires deliberate and strategic investments in production infrastructure, as well as dedicated research and development efforts. Achieving economies of scale without compromising the intrinsic properties of PLGA demands a nuanced approach, encompassing advancements in technology, process optimization, and the development of innovative formulations. Such strategic initiatives are vital in navigating the complexities of scaling up PLGA production, ensuring that increased market demand is met with sustainable, high-quality production processes

PLGA Market Ecosystem

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

"Medical institutions type Segment type was the second largest segment for PLGA market in 2023, in terms of value."

Medical institutions represent a vital end-use industry for PLGA (poly(lactic-co-glycolic acid), leveraging its unique properties to drive advancements in healthcare delivery, patient treatment, and medical device innovation. PLGA, renowned for its biodegradability, biocompatibility, and tunable characteristics, serves as a cornerstone material in a multitude of medical applications. From drug delivery systems to tissue engineering scaffolds and implants, PLGA plays a pivotal role in addressing diverse medical challenges. In drug delivery, PLGA facilitates controlled and sustained release of therapeutics, enhancing treatment efficacy, minimizing side effects, and improving patient compliance. Medical devices incorporating PLGA, such as surgical sutures, implants, and stents, benefit from its biocompatibility and mechanical strength, offering safe and reliable solutions for patient care. Additionally, PLGA-based tissue engineering scaffolds provide a platform for regenerative medicine, enabling the repair and regeneration of damaged tissues and organs. With medical institutions at the forefront of healthcare innovation, the demand for PLGA continues to escalate, driving research and development efforts to further optimize its properties and expand its applications.

"Asia Pacific was the fastest growing market for PLGA in 2023, in terms of value."

The Asia-Pacific region is rapidly emerging as a lucrative market for PLGA (poly (lactic-co-glycolic acid)), fueled by a convergence of factors that present compelling opportunities for businesses operating in the polymer industry. One of the primary drivers of this growth is the burgeoning healthcare sector in countries across Asia-Pacific, characterized by increasing investments in pharmaceuticals, biotechnology, and medical devices. As the demand for advanced drug delivery systems, implants, and tissue engineering scaffolds continues to rise, there is a corresponding surge in the adoption of PLGA, which offers exceptional biodegradability, biocompatibility, and tunable properties perfectly suited to meet the evolving needs of the healthcare industry. Moreover, the region's robust manufacturing infrastructure, coupled with a skilled workforce and favorable regulatory environment, positions Asia-Pacific as an attractive destination for PLGA production and processing.

To know about the assumptions considered for the study, download the pdf brochure

PLGA Market Players

The key players in this market Evonik (Germany), Corbion NV (Netherlands), Ashland (US), Mitsui Chemicals (Japan), Jinan Digang Bioengineering Co., Ltd. (China), Merck (Germany), Akina, Inc. (US), Nomisma Healthcare Pvt. Ltd. (India), Bezwada Biomedical, LLC (US), CD Bioparticles (US).

PLGA Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2020-2022 |

|

Base Year |

2023 |

|

Forecast period |

2024–2030 |

|

Units considered |

Ton; Value (USD Million/Billion) |

|

Segments |

Composition, Processibility, End-use Industry Application, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Evonik (Germany), Corbion NV (Netherlands), Ashland (US), Mitsui Chemicals (Japan), Jinan Digang Bioengineering Co., Ltd. (China), Merck (Germany), Akina, Inc. (US), Nomisma Healthcare Pvt. Ltd. (India), Bezwada Biomedical, LLC (US), CD Bioparticles (US). |

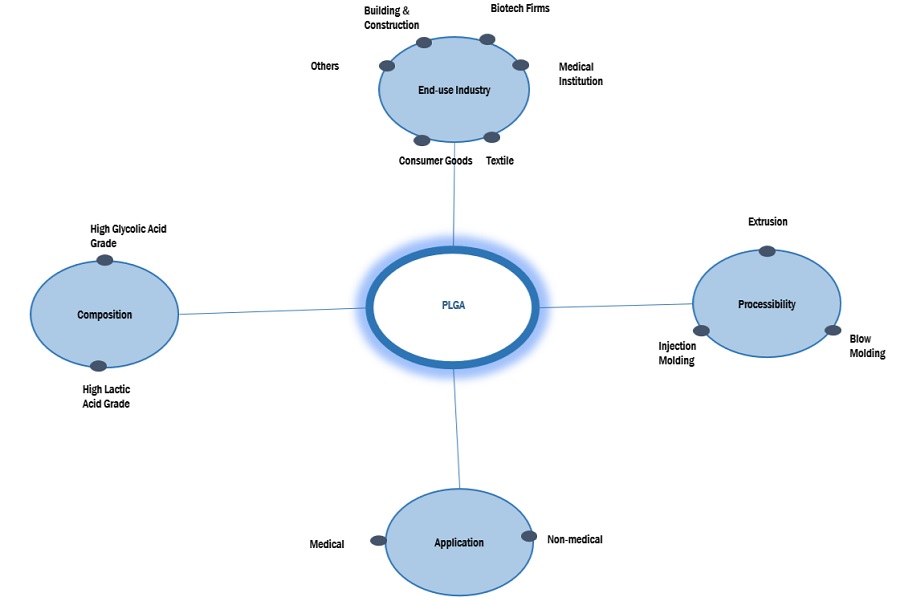

This report categorizes the global PLGA market based on composition, processibility, end-use industry, application, and region.

PLGA Market based on the Composition:

- PLGA 50:50

- PLGA 55:45

- PLGA 65:35

- PLGA 75:25

- PLGA 85:15

- PLGA 12:88

- PLGA 10:90

- Others

PLGA Market based on the Processibility:

- Extrusion

- Injection Moulding

- Others

PLGA Market based on the Type:

- Dayglow Pigments

- Phosphorescent Pigments

- Other Types

PLGA Market based on the Application:

- Drug Delivery

- Medical Implants

- Tissue Engineering

- Diagnostics Imaging Agents

- Fracture Fixation

- Gene Delivery

- Surgical Sutures

- Cosmetics & Dermatology

- Packaging

- Disposable Cutlery

- Textile

- Agricultural Films

- Others

PLGA Market based on the End-use industry:

- Healthcare

- Biotech firms

- Medical Institutions

- Packaging

- Textile

- Agriculture

- Other End-Use Industries

PLGA Market based on the Region:

- Asia Pacific

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In March 2023, Evonik joined BellaSeno to commercialize innovative 3D-printed scaffolds for bone regeneration.

- In August 2022, Ashland has unveiled a strategic expansion of its Viatel bioresorbable polymer manufacturing and research and development facility located at the National Science Park in Mullingar, Ireland. The National Science Park is a hub for innovative organizations.

- In April 2021, Corbion is expanding its production capacity by 40% of lactic acid and its derivatives at its Blair, Neb., plant. This move will help the company to meet the global demand.

- In December 2020, Evonik has acquired the LACTEL business of biodegradable polymers from Durect Corporation for USD 15 Million. This move marks a consequential step in the growth agenda of Evonik’s life-science division Nutrition & Care.

- In June 2020, Evonik launched the RESOMER Precise platform, offering custom functional polymeric excipients. This platform empowers pharmaceutical companies to achieve an unprecedented level of accuracy and precision in controlling the release profile of their parenteral drug products, a capability that was previously unattainable. It is also helping to optimize drug product stability and thereby further reduce regulatory risk for a range of complex parenteral drug products.

Frequently Asked Questions (FAQ):

What is the expected growth rate of the PLGA market?

The forecast period for the PLGA market in this study is 2023-2030. The PLGA market is expected to grow at a CAGR of 16.8 %in terms of value, during the forecast period.

Who are the major key players in the PLGA market?

Evonik (Germany), Corbion NV (Netherlands), Ashland (US), Mitsui Chemicals (Japan), Jinan Digang Bioengineering Co., Ltd. (China), Merck (Germany), Akina, Inc. (US), Nomisma Healthcare Pvt. Ltd. (India), Bezwada Biomedical, LLC (US), CD Bioparticles (US) are the leading manufacturers of PLGA.

What are some of the strategies adopted by the top market players to penetrate emerging regions?

The major players in market use, product launch, investment, and expansion as important growth tactics.

What are the drivers and opportunities for the PLGA market?

Government initiatives and regulations are driving the market during the forecast period. Global expansion in the healthcare industry acts as an opportunity during the forecast period.

Which are the key technology trends prevailing in the PLGA market?

The key technologies prevailing in the PLGA market include nanoparticle formulations, and smart PLGA system. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

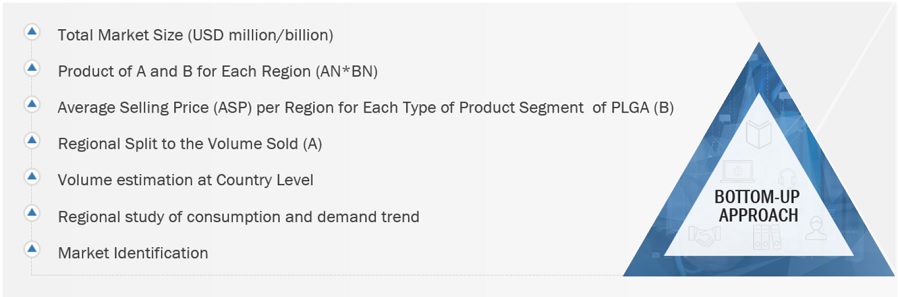

The study involved four major activities in estimating the market size of the PLGA market. Exhaustive secondary research was done to collect information on the market, the peer market, and the grandparent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, gold standard and silver standard websites, and databases. Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

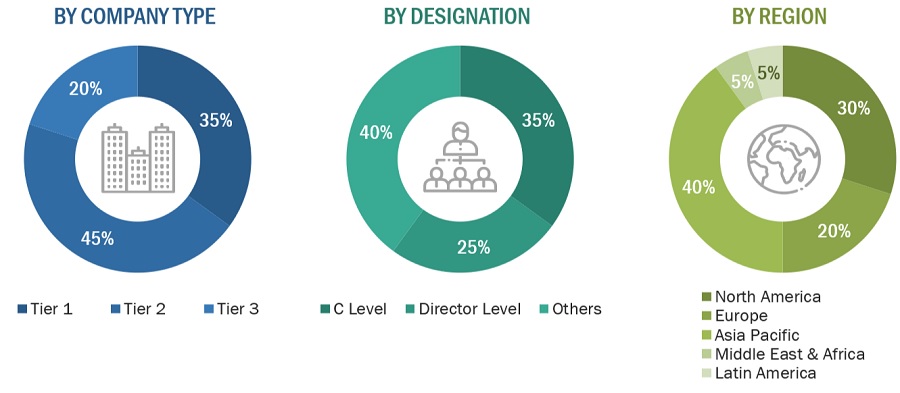

The PLGA market comprises several stakeholders in the value chain, which include manufacturers, and end users. Various primary sources from the supply and demand sides of the PLGA market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in healthcare sector. The primary sources from the supply side include manufacturers, associations, and institutions involved in the PLGA industry. Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to composition, processibility, application, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of PLGA and outlook of their business, which will affect the overall market.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the PLGA market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Top - Down Approach-

To know about the assumptions considered for the study, Request for Free Sample Report

Bottom - Up Approach-

Data Triangulation

After arriving at the total market size from the estimation process, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

PLGA, a group of biodegradable polymers approved by the FDA, stands out for its robustness, excellent biocompatibility, and extensive research as carriers for drugs, proteins, and diverse macromolecules like DNA, RNA, and peptides. Its popularity in the realm of biodegradable polymers stems from its extensive clinical track record, advantageous degradation properties, and potential for prolonged drug release.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

- Manufacturers

- Raw Material Suppliers

Report Objectives

- To define, describe, and forecast the size of the PLGA market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on composition, processibility, end-use industry, application, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Tariff & Regulations

- Regulations and Impact on PLGA market

Growth opportunities and latent adjacency in PLGA Market