Industrial Vehicles Market by Vehicle Type (Forklifts, Aisle Trucks, Tow Tractors, Container Handlers), Drive Type (ICE, Battery-operated, Gas-powered), Application, Capacity, Level of Autonomy, & Region - Global Forecast to 2030

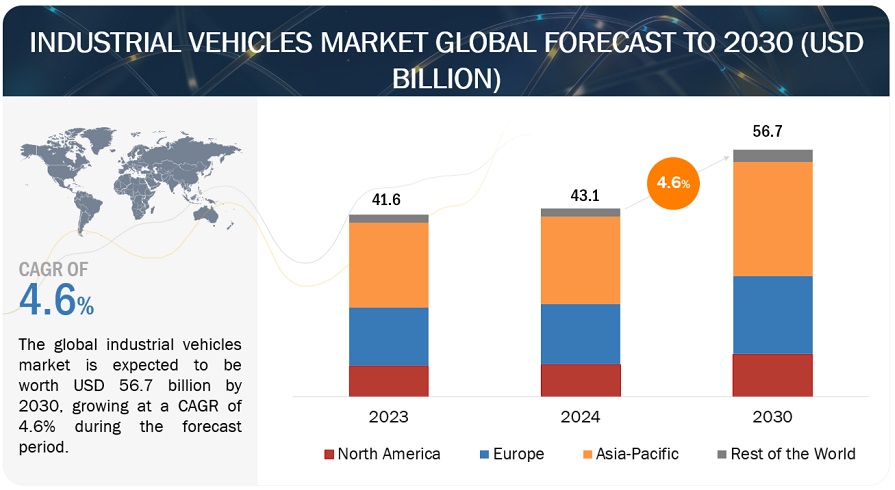

[399 Pages Report] The global industrial vehicles market size is projected to grow from USD 43.1 billion in 2024 to USD 56.7 billion by 2030, at a CAGR of 4.6%. The rapid growth of the e-commerce industry is driving substantial expansion in the global industrial vehicles market, prompting the need for effective material handling solutions. With the continuous rise of online retail, there is a growing requirement for warehouses and distribution centers equipped with industrial vehicles like forklifts and automated guided vehicles (AGVs) to optimize operations. Moreover, heightened attention to workplace safety standards is fueling the adoption of industrial vehicles, aimed at reducing accidents and boosting productivity within industrial environments.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Industrial Vehicles Market:

Driver: E-commerce expansion and warehousing dynamics

The e-commerce sector is experiencing remarkable growth, fueled by the widespread adoption of smartphones and internet connectivity. Major players like Amazon and eBay are driving this expansion, offering consumers unparalleled convenience and choice in their shopping experiences. Factors such as easy purchasing, diverse product options, and flexible return policies are enticing consumers to shift towards online shopping, leading to a surge in both Business-to-Consumer (B2C) and Business-to-Business (B2B) transactions across various industries like pharmaceuticals, household goods, and food. As a result, the demand for warehousing facilities is increasing to accommodate the storage and distribution of goods purchased online, driving the growth of the warehousing sector. This, in turn, is expected to boost the demand for industrial vehicles used in logistics and transportation operations as e-commerce businesses seek to optimize their supply chain networks and enhance operational efficiency. Amazon (US) dominates the warehouse segment with over 1,500 warehouses across the UK, France, Germany, Italy, Canada, and the US, out of around 17,000 warehouses considered. Amazon surpasses its closest competitor, Walmart (US), by approximately 80% in warehouse count. Target (US) also holds a significant presence in this market. As more consumers turn to online channels for their shopping needs, there will be a consequent increase in the demand for industrial vehicles to support logistics and transportation operations, reflecting the evolving dynamics of the market.

Restraint: High maintenance and repair costs for industrial vehicles

High maintenance and repair costs in industrial vehicles like forklifts reach trucks, tow tractors, boom lifts, scissor lifts, and others pose a significant market restraint within the industrial vehicles industry. These vehicles are essential for various material handling and lifting tasks in warehouses, construction sites, and manufacturing facilities. However, their complex machinery and heavy usage often lead to frequent maintenance requirements and occasional repairs, resulting in substantial expenses for owners. Skilled technicians are typically needed to diagnose issues and repair, adding to the overall cost. Additionally, downtime during maintenance and repair activities can disrupt operations, impacting productivity and profitability for businesses reliant on these vehicles. The high cost of maintenance and repairs may deter potential buyers from investing in industrial vehicles or prompt them to explore alternative solutions, thereby limiting market growth. Consequently, finding cost-effective maintenance solutions and strategies to minimize repair needs are crucial for addressing this market restraint and fostering industry growth.

Opportunity: Emergence of rental and leasing in the industrial vehicles sector

The industrial vehicles market is witnessing a promising growth trajectory, propelled mainly by the increasing emphasis on rental and leasing services. Leading players such as United Rentals (US) and Big Rentz (US) are at the forefront of this trend. New projects often require industrial vehicles at various locations according to project dynamics, so the flexibility provided by rental and leasing options becomes crucial. Instead of making substantial upfront investments in vehicle purchases, businesses opt for the agility and cost-effectiveness of rental and leasing arrangements. This preference is particularly evident when specialized equipment or short-term usage is needed, making renting or leasing vehicles tailored to specific project needs more financially prudent. Consequently, the growing inclination towards leasing and renting industrial vehicles is anticipated to persist, driven by the demand for flexibility and cost-efficiency in an ever-changing industrial environment.

Challenge: Cost-competitive workforce in emerging markets

Adopting automated technologies across industries faces limitations in countries like India, Mexico, and Nigeria, where labor wages are low. Due to abundant cheap labor, automating industrial facilities may not be economically viable. For instance, the average daily wage of a semiskilled worker in countries like Indonesia and Vietnam is around USD 9 and USD 10, respectively. Similarly, countries like Bangladesh and Mexico also boast low average daily wages, contributing to the reluctance of companies in these emerging economies to invest in automated industrial vehicles like AGVs and electric forklifts. Instead, many manufacturing operations in these countries rely on manual labor and semiautomatic machines, as this approach remains profitable. Consequently, despite advancements in automation, the prevalence of automated technologies in manufacturing facilities in emerging economies remains comparatively lower than in developed countries.

Industrial Vehicles Market: Ecosystem

The industrial vehicles market ecosystem encompasses a diverse array of players, each contributing to developing and delivering cutting-edge solutions. Key participants include industrial vehicle manufacturers, dealers, distributors, and part and component manufacturers. Within this ecosystem, industrial vehicle manufacturers play a central role in designing and producing a wide range of vehicles tailored to specific industrial applications. Dealers and distributors ensure these vehicles' efficient distribution and servicing, connecting manufacturers with end-users across various industries. Additionally, part and component manufacturers supply essential elements such as engines, transmissions, tires, and hydraulic systems, which are essential for the operation and maintenance of industrial vehicles. Collaboration among these stakeholders is vital for driving innovation and meeting the evolving needs of industrial customers. Through strategic partnerships and cooperation, the industrial vehicles market ecosystem strives to deliver reliable, efficient, and cost-effective solutions to enhance productivity and safety in industrial operations. Prominent companies in this market include Toyota Industries Corporation (Japan), KION Group AG (Germany), Mitsubishi Logisnext Co., Ltd. (Japan), Jungheinrich AG (Germany), and Crown Equipment Corporation (US), among others.

The forklift segment is estimated to exhibit the largest growth in the global industrial vehicles market.

The forklift segment holds the largest share in the industrial vehicles market. Despite the rising demand for Internal Combustion Engine (ICE)-operated forklifts, there is a projected significant reduction in the production volume of ICE-operated forklifts in the future due to factors such as the increasing demand for battery-operated forklifts and concerns related to the high-cost and emission levels of ICE forklifts. Factors such as the growth of industrial manufacturing, the rising demand for electric forklifts across various end-use industries, and the introduction of safety and environmental regulations are expected to support the forklift segment in the industrial vehicles market in the coming years.

Industrial vehicle manufacturers consistently focus on new product development and expansion to enhance their respective portfolios. For instance, in May 2023, Linde Material Handling introduced the new X35X50 electric forklift trucks, featuring front-wheel drive and powered by dual permanent magnet-assisted synchronous reluctance motors (SRM+). Similarly, in July 2021, Hangcha Group Co., Ltd. (China) launched its new XH series 2.0t-3.5t electric forklift truck, equipped with high-voltage lithium-ion batteries, delivering superior performance in terms of productivity, efficiency, reduced noise, and zero emission levels.

The warehousing segment is expected to have significant growth in the industrial vehicles market during the forecast period.

Warehousing, a crucial process for storing goods intended for future sale or distribution, enables manufacturers, distributors, and retailers to hold goods while securely monitoring inventory levels. Key material handling equipment in warehouses includes forklifts and conveyors. The demand for industrial vehicles has increased, driven by their numerous advantages, including enhanced efficiency, high accuracy, and reduced resource wastage. Notably, industrial vehicles such as forklifts, tow tractors, and aisle trucks play essential roles in warehouse material handling tasks, including loading and unloading products, pallet movement, and overall goods transportation. These vehicles facilitate swift and safe product movement in confined warehouse spaces, reducing manual material handling-related injuries.

Several factors contribute to the growth of the warehousing segment, including the thriving e-commerce industry and the increasing demand for more efficient and reliable large-order handling methods. Additionally, the trend toward more significant product differentiation and a reduction in pallet sizes is expected to fuel the demand for industrial vehicles in warehouse applications throughout the forecast period. The substantial global expansion in the e-commerce sector is set to drive demand for logistics and warehousing, particularly in the industrial and manufacturing segments. For instance, in November 2023, KION Group AG announced the introduction of 24-volt Fuel Cell Systems for its warehouse trucks, with a production capacity of up to 5,000 fuel cell systems per year at the Hamburg plant. Furthermore, in June 2023, Mitsubishi Logisnext Co., Ltd. and Jungheinrich AG formed a new joint venture named Rocrich AGV Solutions (US), which will offer AGV products from Rocla (Mitsubishi Logisnext Co., Ltd.) and Jungheinrich AG, along with warehouse solutions and production facilities in North America. This surge in demand for warehousing is anticipated to propel the demand for industrial vehicles in the global market.

The chemical segment is expected to have significant growth in the industrial vehicles market during the forecast period.

Industrial vehicles play a crucial role in the chemical industry, where they are extensively utilized for various material handling tasks. These tasks include the movement of heavy drums and containers, loading and unloading raw materials, and transporting finished products. Given the unique material handling requirements of the chemical industry, mainly due to the hazardous nature of the chemicals involved, industrial vehicles like forklifts are well-suited for these applications. They are instrumental in handling drums and containers containing hazardous materials such as acids, alkalis, and solvents. Operators of industrial forklifts undergo specialized training to handle these materials safely, and they are mandated to use personal protective equipment (PPE) such as gloves, goggles, and respirators. Routine operations in the chemical industry entail working with various hazardous chemical compounds, exposing workers in chemical plants to potentially harmful environments. This affects their work efficiency and poses challenges in maintaining maximum production efficiency.

Consequently, companies need to conduct thorough assessments of storage areas and handling practices to prevent accidents. The deployment of non/semi-autonomous and fully autonomous industrial vehicles in chemical manufacturing can significantly enhance work effectiveness and safety. By implementing these vehicles; companies can ensure the safety of employees working with hazardous raw materials, thereby improving the productivity and efficiency of warehousing operations. The demand for chemical end products is on the rise, with China and India anticipated to be the world's largest producers of chemicals during the forecast period. The chemical industry operates under stringent regulations, necessitating standardized systems in warehouses and manufacturing plants to comply with Good Manufacturing Practices (GMP) standards. Industrial vehicles are instrumental in enabling the chemical industry to perform specific functions, such as ensuring specialized storage areas for herbs, narcotics, and hazardous chemicals, minimizing lead time, eliminating errors, ensuring a reliable supply of various chemicals, and facilitating the sorting and control of products that have expired in accordance with GMP standards. Companies such as Jungheinrich AG, Hyster Yale Materials Handling Inc, Hangcha Group Co Ltd, Noblelift Intelligent Equipment Co Ltd, and Konecranes offer a range of industrial vehicles tailored for use in the chemical industry.

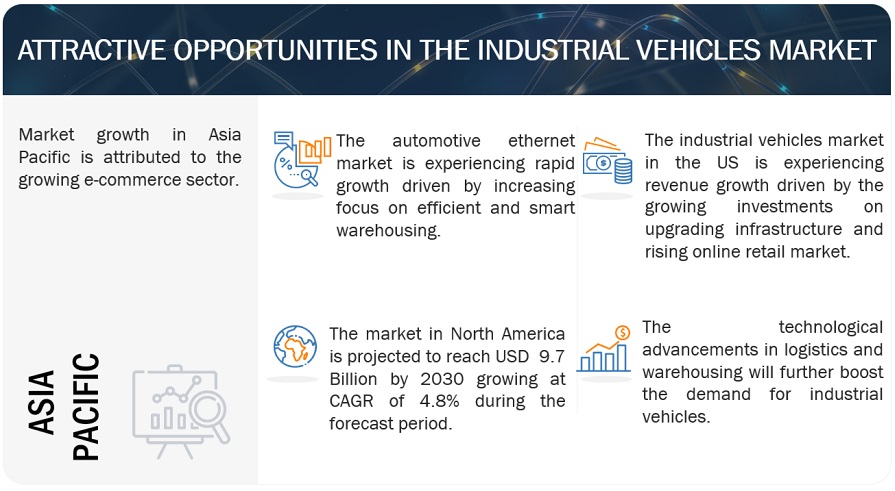

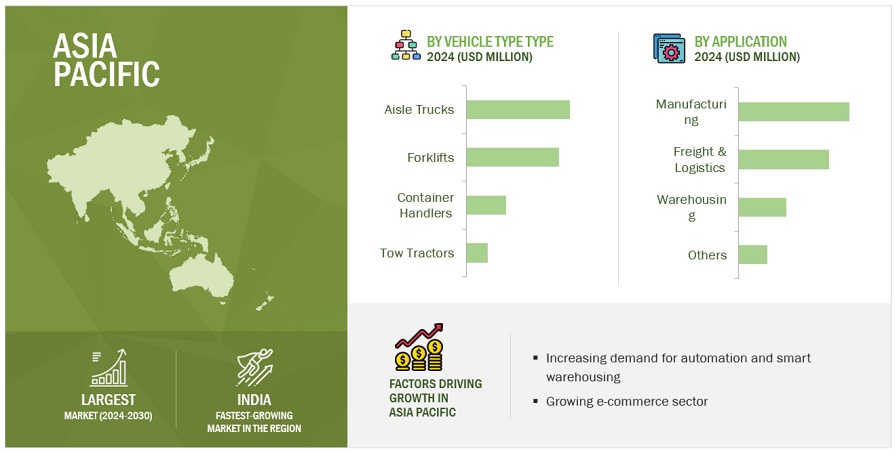

"The Asia Pacific industrial vehicles market is projected the largest growth by 2030."

Asia Pacific is estimated to be the largest industrial vehicles market by 2030. The industrial vehicles market is expanding rapidly across Asia Pacific, with individual countries such as China, Japan, India, South Korea, and the rest of the Asia Pacific countries playing a vital role. The region is prominent as a leading producer of industrial vehicles and home to some of the world's fastest-developing economies like China and India. This has fueled a steady rise in industrial vehicle production volumes, with OEMs meeting domestic and international demand. Major manufacturers are expanding their regional presence, catering to the country's rapid material handling equipment market growth. China is poised to lead the industrial vehicles market in Asia Pacific, followed by Japan, driven by factors such as high labor costs, the imperative for enhanced production efficiency, and government incentives for industrial infrastructure development.

Moreover, population growth, increasing GDP, and rising per capita income foster additional opportunities for industrial vehicles across the Asia Pacific. Major industrial vehicle manufacturers, such as Toyota Industries Corporation (Japan), Mitsubishi Logisnext Co., Ltd. (Japan), Anhui Heli Co., Ltd. (China), and more are increasing their presence in the region to cater to the increasing demand. For instance, Cargotec Corporation (Finland) announced in December 2023 that its Kalmar brand is set to start producing electric reach stackers and essential forklift truck range at the company's Shanghai Plant in China. The region's strategic initiatives to enhance industrial efficiency, coupled with substantial investments from major manufacturers, underscore its pivotal role in driving the remarkable growth trajectory of the industrial vehicles market within the Asia Pacific region.

Key Market Players

The global industrial vehicles market is dominated by major players such as Toyota Industries Corporation (Japan), KION Group AG (Germany), Mitsubishi Logisnext Co., Ltd. (Japan), Jungheinrich AG (Germany), Crown Equipment Corporation (US), and Hyster-Yale Materials Handling, Inc. (US), among others.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2019–2030 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2030 |

|

Forecast units |

Value (USD Thousand) |

|

Segments Covered |

Vehicle type & capacity, Drive type, Application, Level of autonomy, Aerial work platforms market (by Type) |

|

Geographies covered |

Asia Pacific, Europe, North America, and Rest of the World |

|

Companies Covered |

Toyota Industries Corporation (Japan), KION Group AG (Germany), Mitsubishi Logisnext Co., Ltd. (Japan), Jungheinrich AG (Germany), and Crown Equipment Corporation (US). |

This research report categorizes the industrial vehicles market based on Vehicle type & capacity, Drive type, Application, Level of autonomy, Aerial work platforms market (by Type), and region

Industrial Vehicles Market, By Vehicle Type & Capacity:

-

Forklifts

- <5 ton

- 5-10 ton

- 11-36 ton

- >36 ton

-

Aisle Trucks

- <1 ton

- 1-2 ton

- >2 ton

-

Tow Tractors

- <5 ton

- 5-10 ton

- 11-30 ton

- >30 ton

-

Container Handlers

- <30 ton

- 30-40 ton

- >40 ton

- Automated Guided Vehicles

- Personnel Carriers

Industrial Vehicles Market, By Drive Type:

- Internal Combustion Engine Industrial Vehicles

- Battery-operated Industrial Vehicles

- Gas-powered Industrial Vehicles

Industrial Vehicles Market, By Application:

-

Manufacturing

- Chemical

- Food & Beverages

- Mining

- Automotive

- Metals & Heavy Machinery

- Others

- Warehousing

- Freight & Logistics

- Others

Industrial Vehicles Market, By Level of Autonomy:

- Non/Semi-autonomous

- Autonomous

Aerial Work Platforms Market, By Type:

-

Scissor Lifts

- Scissor Lifts by Drive Type

-

Boom Lifts

- Articulating AWP

- Telescopic AWP

- Boom Lifts by Drive Type

Industrial Vehicles Market, By Region

- Asia Pacific

- Europe

- North America

- Rest of the World

Recent Developments

- In March 2024, EP Equipment (China) announced that Boendgen Baustoffe (Germany) purchased the EFL electric forklift series to upgrade its fleet.

- In January 2024, Hyster-Yale Materials Handling, Inc. (US) launched the J32-40UTTL Li-Ion forklift truck. The new electric truck has a load-carrying capacity of 1.4 to 1.8 tons.

- In December 2023, Konecranes (Finland) announced that it had supplied 7 Konecranes SMV 16-1200 C (16 ton) forklifts to Eldorado Brasil (Brazil) along with two gantry cranes in Q3 of 2023.

- In September 2023, Marvell announced the plans for a new R&D center in Pune, India. This upcoming establishment is expected to double the current workforce capacity.

- In November 2023, KION Group AG announced the launch of 24-volt Fuel Cell Systems for its warehouse trucks. The company added that up to 5,000 fuel cell systems can be produced yearly at the Hamburg plant. The company has invested around USD 11.9 Million in this project.

- In September 2023, Toyota Material Handling Japan (TMHJ), a segment of Toyota Industries Corporation, introduced a new fuel cell lift truck (FC lift truck).

Frequently Asked Questions (FAQ):

What is the current size of the global industrial vehicles market?

The global industrial vehicles market size is estimated to be USD 43.1 Billion in 2024 and expected to reach USD 56.7 Billion by 2030.

Who are the winners in the global industrial vehicles market?

The industrial vehicles market is dominated by global players such as Toyota Industries Corporation (Japan), KION Group AG (Germany), Mitsubishi Logisnext Co., Ltd. (Japan), Jungheinrich AG (Germany), Crown Equipment Corporation (US), and Hyster-Yale Materials Handling, Inc. (US), among others. These companies develop new products, adopt expansion strategies, and undertake collaborations, partnerships, and mergers & acquisitions to gain traction in the industrial vehicles market.

What are the new market trends impacting the growth of the industrial vehicles market?

The new market trends, such as intelligent warehousing and integration of IoT, are impacting the growth of the industrial vehicles market.

Which region is expected to be the largest market during the forecast period?

Asia Pacific is anticipated to be the largest industrial vehicles market due to the increasing e-commerce in the region.

What is the total CAGR expected to be recorded for the industrial vehicles market during 2024-2030?

The market is expected to record a CAGR of 4.6%% from 2024-2030. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

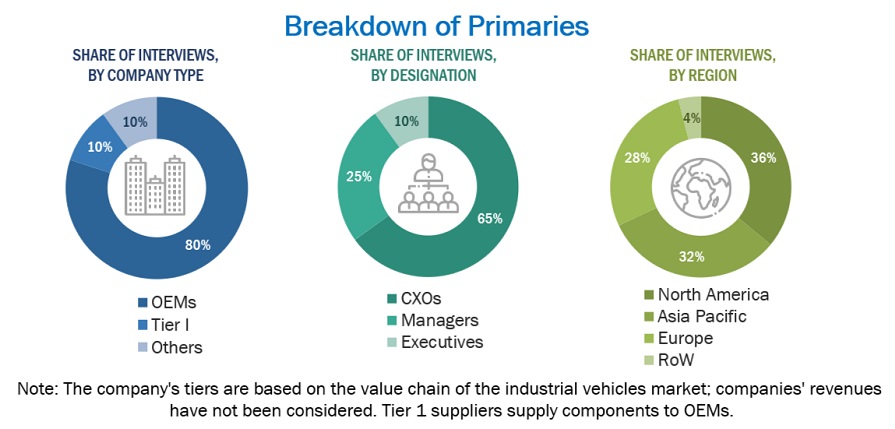

The study involved four major activities to estimate the current size of the industrial vehicles market. Exhaustive secondary research collected information on the market, the peer market, and model mapping. The next step was to validate these findings and assumptions and size them with industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used to determine the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information on the industrial vehicles market for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers, certified publications, and articles from recognized authors; directories; databases; and articles from recognized associations and government publishing sources. Secondary research has been used to obtain key information about the industry's value chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market- and technology-oriented perspectives.

Primary Research

Extensive primary research has been conducted after understanding the industrial vehicles market scenario through secondary research. Several primary interviews have been conducted with market experts from demand-side industrial vehicle product providers and supply-side OEMs across four major regions: North America, Europe, and Asia Pacific. Approximately 21% and 79% of primary interviews have been conducted from the demand and supply sides, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and marketing, were covered to provide a holistic viewpoint in the report.

After interacting with industry experts, we also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter expert opinions, led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value of the industrial vehicles market. Key industrial vehicle market players were identified through secondary research, and their global market shares were determined through primary and secondary research. The research methodology included the study of the annual and quarterly financial reports & regulatory filings of major market players, as well as interviews with industry experts for detailed market insights. All major penetration rates, percentage shares, splits, and breakdowns for the industrial vehicles market were determined using secondary sources model mapping and verified through primary sources. All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data. The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

Global Industrial Vehicles Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Industrial Vehicles Market Size: Top-Down Approach

Data Triangulation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified by primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Market Definition

Industrial vehicles: The industrial vehicles market encompasses the production, distribution, and utilization of specialized vehicles tailored for material handling, transportation, and logistical operations within industrial environments like warehouses, manufacturing facilities, distribution centers, and ports. These vehicles, including forklifts, aisle trucks, tow tractors, and container handlers, are crucial for optimizing operational productivity, safety, and efficiency. Key stakeholders involved in this market include industrial vehicle manufacturers, component manufacturers, industrial vehicle rental/leasing companies, and end-users.

Key Stakeholders

- Associations, forums, and alliances related to industrial vehicles

- Raw material suppliers

- Industrial vehicle distributors and dealers

- Manufacturers of industrial vehicles

- Manufacturers of industrial vehicle components

- Autonomous vehicle solution providers

- Technology vendors

- Industrial vehicle rental/leasing companies

- Material handling associations

- Standards organizations and regulatory authorities related to the material handling industry

Report Objectives

- To segment and forecast the size of the global industrial vehicles market, by value & volume, based on vehicle type & capacity (Forklifts (<5ton, 5-10 ton, 11-36 ton, >36 ton), Aisle trucks (<1ton, 1-2 ton, >2 ton), Tow tractors (<5ton, 5-10 ton, 11-30 ton, >30 ton), Container handlers (<30ton, 30-40 ton, >40 ton), Automated Guided Vehicles, and Personnel Carriers)

- To segment and forecast the size of the global industrial vehicles market by value & volume based on drive type (Internal Combustion Engine Industrial Vehicles, Battery-operated Industrial Vehicles, and Gas-powered Industrial Vehicles)

- To segment and forecast the size of the global industrial vehicles market by value & volume based on application (Manufacturing (Chemical, Food & Beverages, Mining, Automotive, Metals & Heavy Machinery, and Others), Warehousing, Freight & Logistics, and Others)

- To segment and forecast the size of the global industrial vehicles market by value, based on level of autonomy (Non/Semi-autonomous and Autonomous)

- To segment and forecast the size of the global aerial work platforms market, by value & volume, based on Type (Scissor Lifts (Scissor Lifts by Drive Type), Boom Lifts (Articulating AWP, Telescopic AWP), and Boom Lifts by Drive Type)

- To segment and forecast the size of the industrial vehicles market, by value & volume, based on region (Asia Pacific, Europe, North America, and Rest of the World)

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company's specific needs.

- By capacity at the regional level for each vehicle type

- By drive type at the regional level for each vehicle type

- By application at the global level for each vehicle type

Company Information

- Profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industrial Vehicles Market

Which geography is expected to grow at the highest rate among others in the global Industrial Vehicles Market from 2022 to 2030?